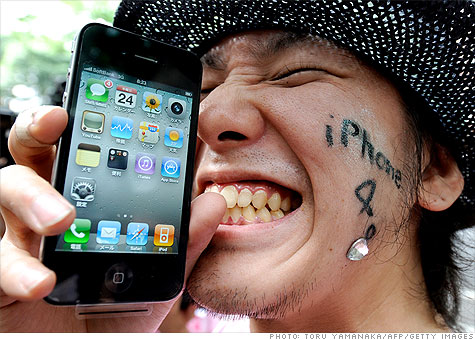

A fan in Tokyo shows off his new iPhone 4.

A fan in Tokyo shows off his new iPhone 4.NEW YORK (CNNMoney.com) -- Despite a very vocal group of detractors, the vast majority of iPhone users love AT&T.

That's the key finding in a survey released this week by Yankee Group, which reports that 73% of iPhone users are very satisfied with AT&T's service. That rating compares favorably to how non-iPhone smartphone users feel about AT&T, and even to how non-iPhone users feel about other wireless providers.

The satisfaction rate of AT&T subscribers as a whole is 68%, and only 69% of smartphone users say they are satisfied with their mobile provider, Yankee Group found.

The results are surprising, given the pounding AT&T has taken in the media and on the blogosphere about its service-related issues with the iPhone. On CNNMoney's recent stories "AT&T and Apple's marriage made in hell," and "AT&T: The most hated company in iPhone land," reader comments were overwhelmingly negative toward the wireless network.

AT&T's recent iPad-related security glitch and mishandling of the iPhone 4 launch likely didn't do much to help its reputation. Plus, iPhone owners pay AT&T nearly $12 a month more for service than the average smartphone user.

Tech analysts like to point out the ways in which AT&T is a drag on the iPhone. Gartner Research Director Carolina Milanesi said last month that AT&T's network has "limited the iPhone experience." And Drake Johnstone, an analyst with Davenport & Co., forecasted that poor experiences with AT&T would drive as many as 40% of iPhone customers to Verizon once that network gets the iPhone.

So what explains Yankee Group's conclusion that iPhone users' love AT&T?

"Consumers transfer the high gloss of their Apple iPhone experience to AT&T," says Carl Howe, Yankee Group analyst and author of the study. "The iPhone creates a halo effect that rubs off."

In other words, iPhone customers' praise for their network may be a result of the famous "reality distortion field" that surrounds Apple (AAPL, Fortune 500) CEO Steve Jobs and his company's products.

But AT&T says its network really isn't as bad as many people think. It's a perception problem, not a service problem, in the company's eyes.

"There's a gap between what people hear about us and what their experience is with us. We think that gap is beginning to close," says Mark Siegel, an AT&T spokesman. "It doesn't mean we're perfect; we still have work to do. But that's no surprise to us, because we have a great network."

Meanwhile, AT&T (T, Fortune 500) continues to reap the rewards of being the country's exclusive iPhone provider.

Despite heavy data demands that drive up AT&T's cost of servicing each customer, users still make the wireless company $50 more per customer each year than other providers get from their smartphone subscribers, according to Yankee Group. That's because a higher percentage of iPhone customers buy pricey, top-tier service plans to satisfy their mobile download demands.

The iPhone will be worth $1.8 billion in sales to AT&T this year, and will generate $9 billion in revenue for the provider over the next five years, the study estimates. Yankee Group says that's $750 million more each year than AT&T would be taking in if it had a different flagship smartphone.

The iPhone is also the gift that keeps on giving: 77% of iPhone owners say they'll buy another iPhone, compared to 20% of smartphone customers who say they'll buy an Android phone. (See correction below)

"Our analysis explains why AT&T has bent over backward to keep its exclusive distribution deal with Apple as long as possible," Howe says. "Verizon has been regretting turning away Apple for the last three years."

Correction: An earlier version of this story incorrectly said that 20% of Android customers say they'll buy another Android phone. The survey actually revealed that 20% of all smartphone customers say they'll buy an Android phone. ![]()

| Markets | Last | Change | % Change |

|---|---|---|---|

| Dow | 10,467.16 | -30.72 | -0.29% |

| Nasdaq | 2,251.69 | -12.87 | -0.57% |

| S&P 500 | 1,101.53 | -4.60 | -0.42% |

| Treasurys | 3.00 | -0.00 | -0.07% |

| U.S. Dollar | 1.31 | 0.01 | 0.41% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Citigroup Inc | 4.12 | 0.03 | 0.73% |

| Bank of America Corp... | 14.03 | 0.04 | 0.29% |

| Ford Motor Co | 12.97 | 0.06 | 0.46% |

| Intel Corp | 21.03 | -0.30 | -1.41% |

| Motorola Inc | 7.61 | -0.07 | -0.91% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Russian energy giant Gazprom tops the list, while BP and Toyota round out the top 5. More |

The financial industry and some lawmakers don't want her to run the consumer agency, fearing she would crusade against the financial system. Her fans say she's what the nation needs. More |

Microsoft CEO Steve Ballmer said the company needs to create a host of iPad competitors, but he gave no timeline for when they'll come to market. More |

Kenneth Feinberg is working overtime to make sure that Gulf area businesses know him, and although obstacles loom, locals express confidence in him. More |

This couple have a communications issue, and their nest egg is suffering as a result. More |